what is a tax lot in real estate

It gives homeowners a chance to pay those taxes along with high penalty fees. Registration with the HLURB or HUDCC as a real estate dealer or developer shall be sufficient for a taxpayer to be considered as habitually engaged in the sale of real estate.

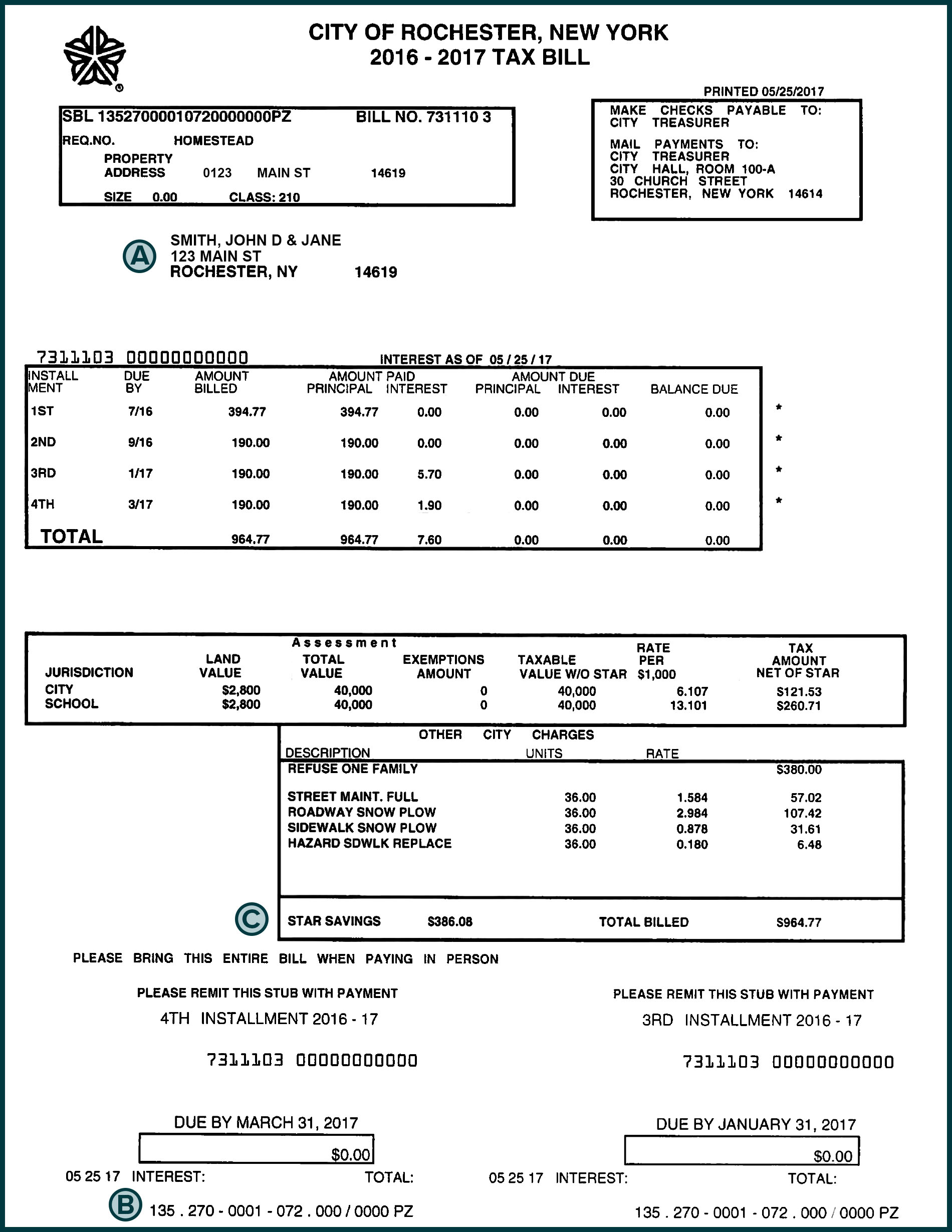

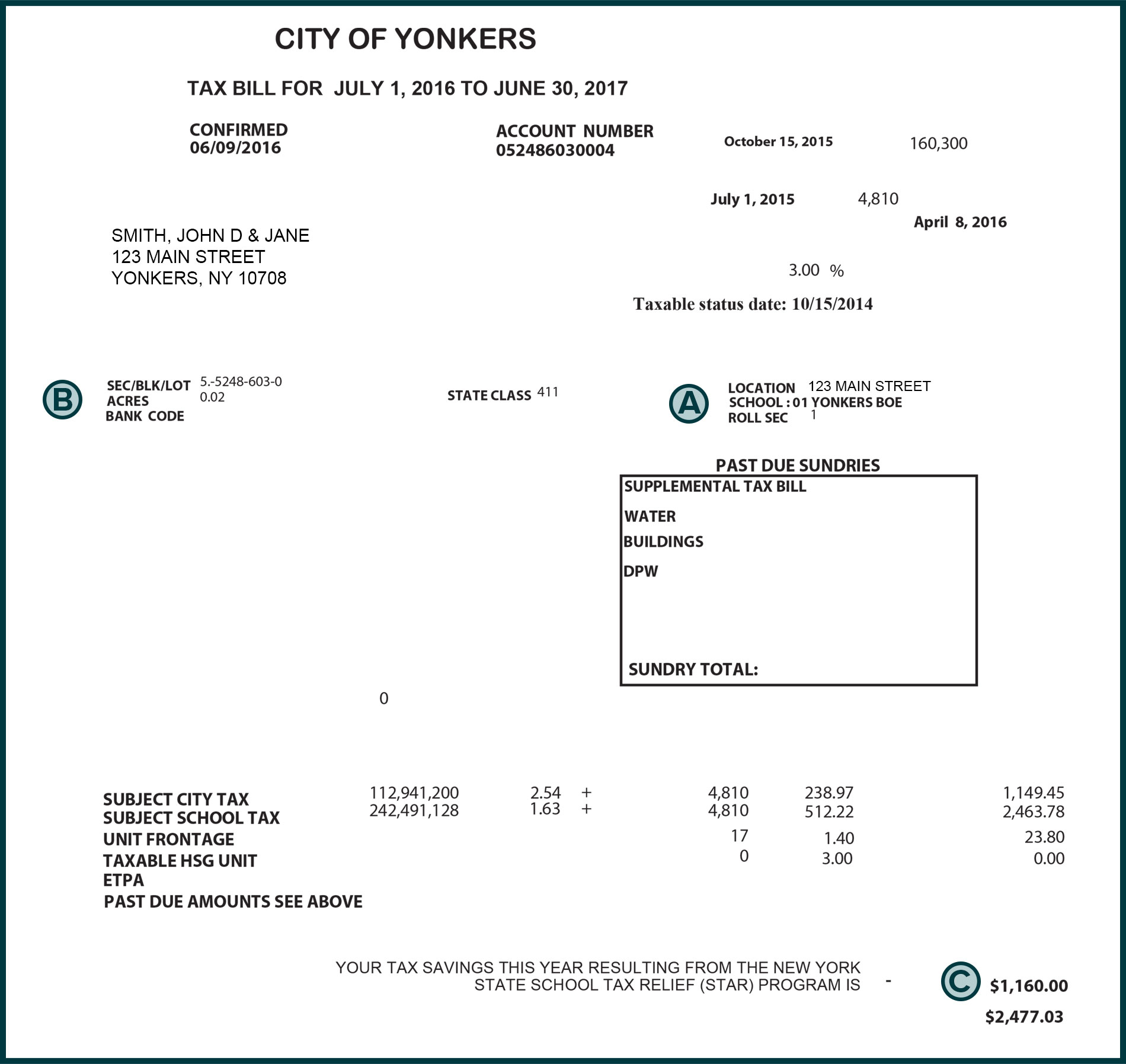

Secured Property Taxes Treasurer Tax Collector

The real property tax rate for Metro Manila Philippines is 2 of the assessed value of the property.

. I am sure a lot of real estate investors are very much interested to know the taxes involved in. Government Stamp Transfer Tax. The sellertransferor is not habitually engaged in the real estate business but the real estate sold is an ordinary asset 60.

For RPT purposes LGUs shall appraise all real properties whether taxable or exempt at their current and fair market value FMV prevailing in the localities where they are. About 2 of the purchase price. Located in the center of Belize City on the south side residential community sits this 2 300 sq.

The buyer usually pays around 125 for closing costs. Last Modified Date. Taxes are indeed inescapable and the real estate industry is no exception.

Essentially your income tax rate is lowered with. In comparison the rate for provincial areas is 1 of the assessed. The amount youll pay to transfer a property into your name can vary some but you can generally expect to pay roughly 125 of the houses sale value at closing.

The exact tax rates depend on the location of the property in the Philippines. The rate of real property tax within the Metropolitan Manila Area is 2 assessed value of the real property. Set in historic and scenic Southern Foreshore this 45 ft by 55 ft Sea Front Lot offers the investor a unique opportunity to purchase.

Tax lot accounting is important because it helps investors minimize their capital gains taxes. Fixer Upper Home on a fully fenced 50 ft. About 5 of the purchase price.

Real estate taxes also known as property taxes are imposed on real estate by a government for services rendered. A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the.

Currently property transfer taxes are at 5 and attorney fees usually equal 2 including miscellaneous expenses. Tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the income tax rate.

Real Property Tax is the tax on real property imposed by the Local Government Unit LGU. In our example above we sold 20 shares of Company XYZ for 10 per share. What is tax lot in real estate.

General Sales Tax for new residential properties. The legal basis is Title II of the Local Government Code LGC Republic Act RA. The sellertransferor is not habitually engaged in the real estate business but the real estate sold is an ordinary asset 60.

Commercial Property Records Reonomy

Deadline Of Real Property Tax In The Philippines 2022 All Properties

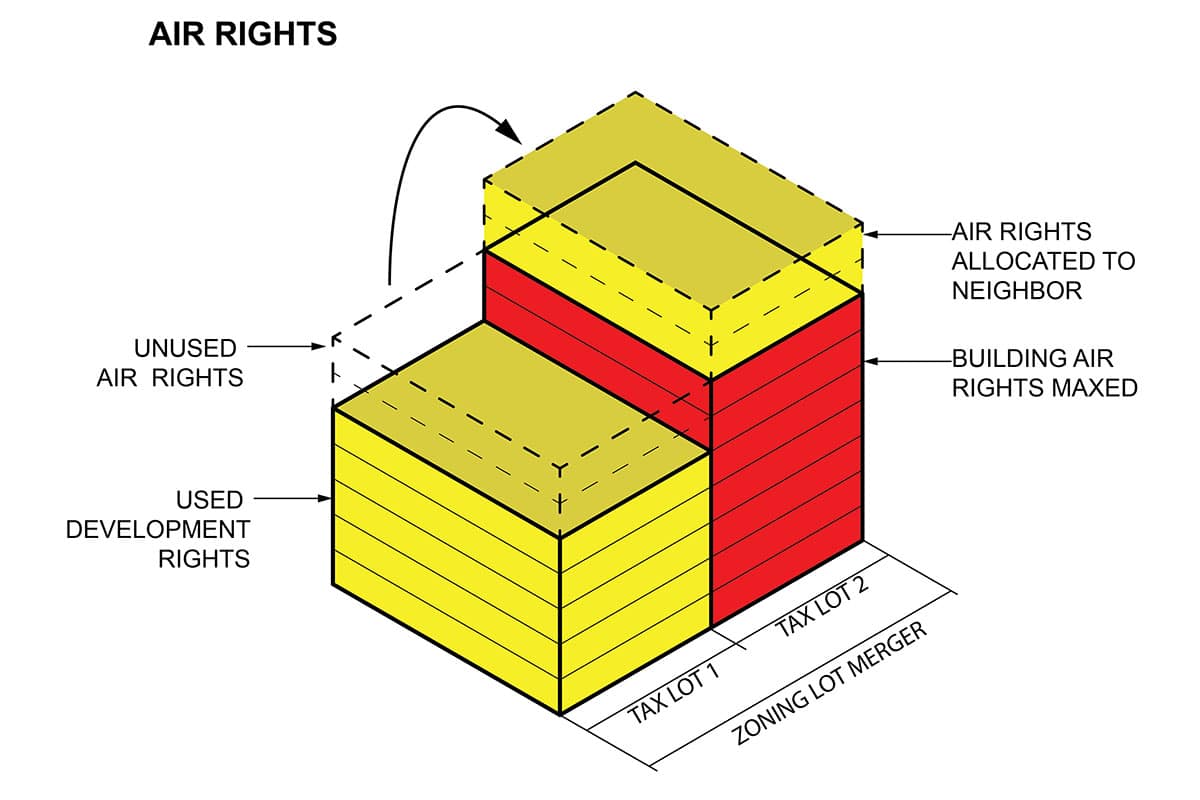

Air Rights Nyc Development Rights Fontan Architecture

Example Methodfinder S Practitioner S Guide

How Property Taxes Apply To Vacant Land Landhub

Why Real Estate Investment Is A Good Investment And How Does It Compare To Investing In The Stock Market

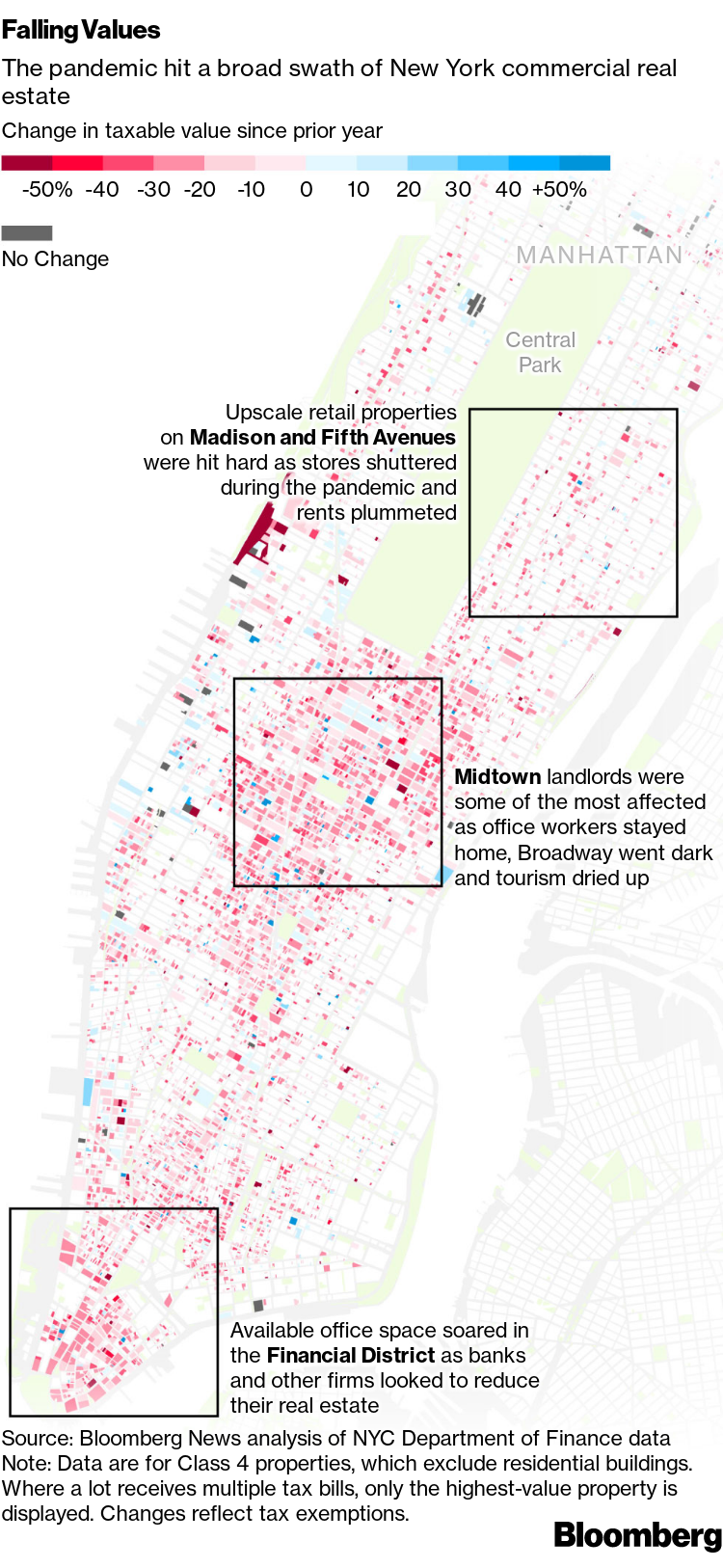

Tax Bills Reveal Covid S Hit To New York Real Estate

Looking For A Real Estate Bargain It S County Tax Sale Time Hamtramck Review

1889 Real Estate Tax Bill Receipt San Francisco California Ca Lot Of 7 Ebay

Capital Expenditure Capex Definition

Decoding The Mls Tax Roll Square Footage Numbers The Real Estate Coconut

E Antler Ave Redmond Or 97756 Tax Lot 10 And 12 Loopnet

2020 Assessor S Report Real Estate On The Rise Marathon Joins Tax Roll L Observateur L Observateur

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

How Real Estate Property Taxes Work Howstuffworks